Decarbonisation of road freight is a key policy objective in the European Union (EU). As such, the transport sector finds itself under mounting pressure to transition towards more sustainable practices. Within this sector, the adoption of zero-emission vehicles (ZEVs), such as battery electric trucks (BETs), represents a major step toward achieving cleaner and more efficient logistics operations. However, the transition to electric trucking faces significant infrastructure gaps. What is being done to accelerate the rollout of charging infrastructure for electric vehicles (EVs) across Europe?

BEV Technology Sets the Stage

Despite improvements in the fuel efficiency of heavy-duty vehicles (HDVs) over the past decade, there has not been a reduction in total greenhouse gas (GHG) emissions from conventional diesel trucks. This is primarily due to the rise in demand for road freight transport, which has outpaced the efficiency gains achieved. As an alternative, zero emission trucks (ZETs) have gained substantial momentum in recent years across the EU. Their uptake has increased significantly from approximately 100 registrations in 2017 to over 1,600 in 2022, according to a report for the European Clean Trucking Alliance (ECTA).

Within the ZET segment, battery electric trucks (BETs) have experienced the most substantial increase, driven by policy support, technological advancements, and economic competitiveness. According to the report by the ECTA, 97% of ZET sales in 2020 were attributed to battery electric vehicles (BEVs). European vehicle manufacturers have intensified their efforts to produce electric vehicles: by the end of 2023, 41 new models of BETs over 3.5 tonnes were launched in the European market, diversifying options for operators.

However, consumer anxiety over the limited range of battery electric HDVs, as well as payload restrictions, remain a barrier for large scale adoption of BEVs, including battery electric trucks. Manufacturers are racing to solve these technological challenges and their advancements are clearly visible – today’s electric trucks have an increased range compared to a decade ago and can run up to 250 – 300 kilometres at a time.

Technological challenges persist, particularly in developing long-haul BETs. But as technology advances and costs decrease over time, ZETs are expected to become more competitive in terms of pricing, efficiency, and range, appealing to commercial fleet operators across various applications. Meanwhile, the electric trucks available today are ideal for urban, domestic and short- to medium-range deliveries or round trips.

“If we look at all the goods being transported in Europe, depending on the year, around 40-45% travel less than 300 kilometres per day. This is a range that we can easily handle with our charging today,” highlighted Stefan Widlund, Electromobility Director at Volvo Trucks, discussing the Volvo FM Electric heavy-duty truck in an interview with Girteka.

“If you then charge, you will have a significantly longer range – we have examples of our trucks running up to 640 kilometres per day with some top-up charging during the day. The charging only takes 90 minutes to go from 0% to 80%. However, in many cases, you only need to charge from 30% to 80%. This can be done during the scheduled 45-minute rest breaks for drivers. Hence, the issue of range can be managed with daily top-up charging while in operation, but to do that, we need more public charging stations in Europe,” concluded Widlund.

The EU’s Public Charging Infrastructure

In 2022, there were around 2.7 million public EV charging points globally. Out of these, 900,000 were installed over one year, accounting for 55% growth for the period 2021-2022. According to data presented in the Global EV Outlook 2023, China remains ahead of any other market, including Europe, in terms of both EV sales and charging stations. In 2022, the country already had more than 1.7 million EV charging points installed, whereas Europe reached less than half of that number.Industry stakeholders have been calling on EU legislators to address the dire need for a robust charging infrastructure, along with sufficient grid capacity, that would accommodate the growth of the electric vehicle fleet.

“The lack of publicly accessible charging and refuelling infrastructure dedicated to trucks is viewed as a primary roadblock to a faster transition and fleets would welcome additional support from other stakeholders to plan the build-out of infrastructure,” according to research by the International Council on Clean Transportation (ICCT), which spoke to its European Clean Truck Alliance (ECTA) members, including Girteka.

Hearing these concerns, in 2021, the European Commission (EC) proposed the EU Alternative Fuel Infrastructure Regulation (AFIR). The regulation, which was finally adopted by the European Council in July 2023, is part of the EU’s “Fit for 55” package. For the first time, the AFIR sets a legally binding national and EU-wide targets for the deployment of alternative fuels infrastructure for road vehicles, vessels, and stationary aircraft.

The AFIR requires that public chargers for electric trucks be provided at regular intervals along Europe’s primary and secondary motorways, and in major cities. According to the regulation, recharging stations for HDVs (above 3.5 tonnes) with a minimum output of 350kW must be deployed:

- At every 60 km along the Trans-European Transport Network (TEN-T) core network (main roads).

- At every 100 km on the larger TEN-T network from 2025 onwards, with complete network coverage by 2030.

The regulation also states that at least two recharging points must be deployed in each safe and secure parking area by the end of 2027 and four by the end of 2030. Recharging stations must also be set up in urban nodes. Targets for the minimum capacity of, and maximum distance between, hydrogen refuelling stations for both cars and trucks are also included in the regulation.

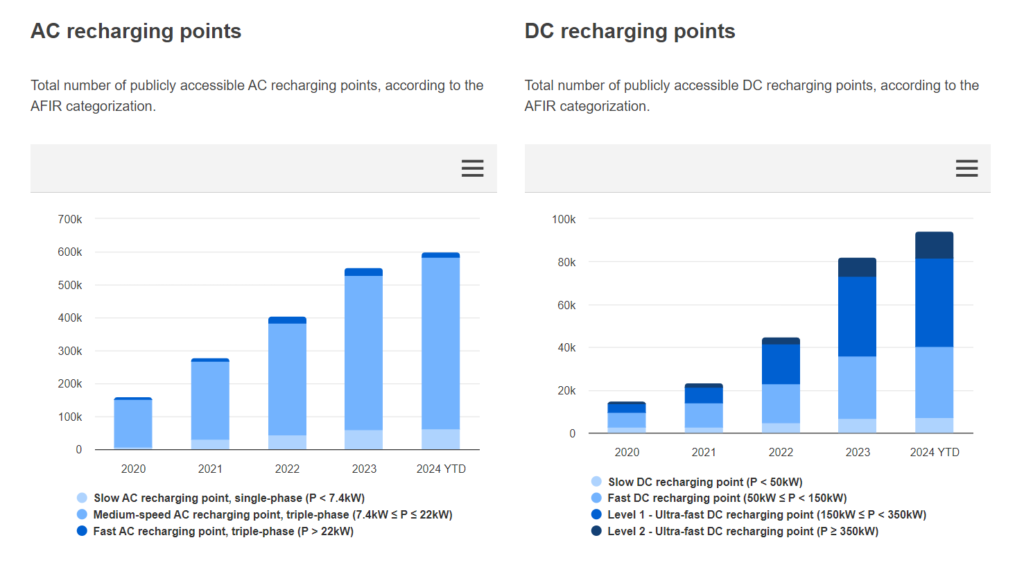

When looking at the data provided by the European Alternative Fuels Observatory (EAFO), progress has been made in rolling out of EV charging infrastructure across the EU. The number of public AC charging points within the EU-27 has grown from over 120,000 in the beginning of 2020, to almost 600,000 in the same period in 2024. Meanwhile, the number of DC charging points rose from over 6,000 to more than 90,000 during the same period.

Source: EAFO

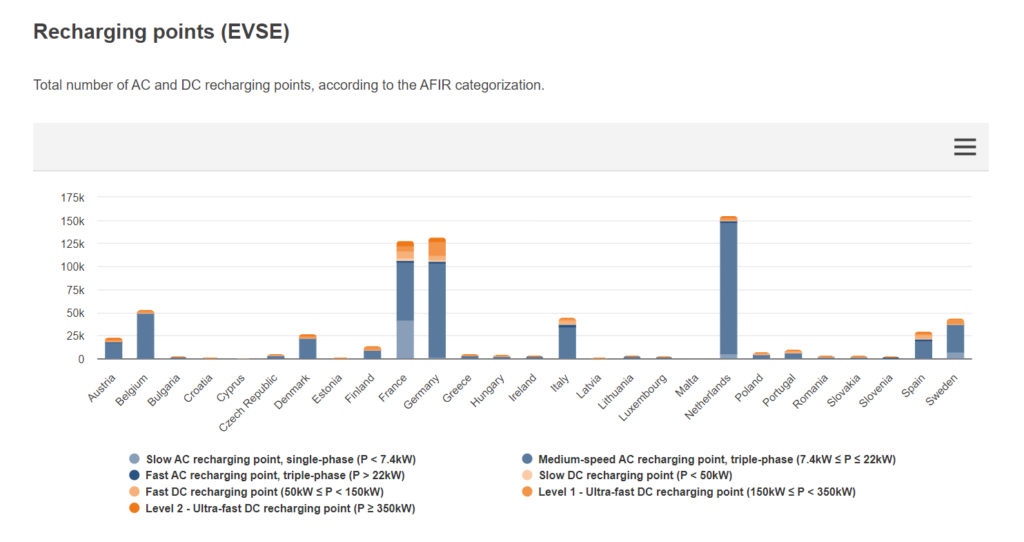

Aside of expanding public charging infrastructure across Europe and securing enough power for the growing fleet of BEVs, there is also the issue of even distribution of charging infrastructures. In terms of countries leading the public charging station market within the EU-27, the Netherlands takes the lead with over 150,000 charging points (both AC and DC) installed as of Q1 2024, followed by Germany and France.

Source: EAFO

From the data presented above, it is safe to say there is a large disparity in the distribution of public EV charging points across the EU, with many Western European countries being far ahead of their Eastern European counterparts in terms of charging infrastructure deployment.

Another concern is the pace of public charging infrastructure rollout. The number of public charging stations available within the EU-27 more than doubled in the last two years: from around 300,000 in Q1 2021 to 700,000 in Q1 2024. However, an analysis by McKinsey indicates that in even the most conservative scenario, the EU-27 will need an estimated 3.4 million operational public charging points by 2030 to meet the needs of its future EV fleet.

That figure, which does not include residential and workplace charging, includes 2.9 million public chargers for passenger cars, 0.4 million for light commercial vehicles, and 0.1 million for trucks and buses. According to the study, it would require an acceleration from roughly 1,600 installations of public charging points a week in 2021 to around 10,000 a week in 2030.

What About the Private Initiatives?

Electric trucks are being used on various missions, including for transporting parts and/or goods between factories or moving freight from ports or airports to companies’ warehouses. On certain established lanes, they can be doing round trips constantly, which means that their route structure is known beforehand, making the issue of charging a matter of proper planning.

For instance, bp pulse’s state-of-the-art simulation software helps fleet operators and fleet managers to simulate their vehicles as EVs, operating on typical routes and schedules. This provides the operators with insights into how their vehicle would perform if it were electric. The simulation takes into consideration battery efficiency, topography, weather conditions as well as other parameters.

“We can estimate how the vehicle will perform if it were an EV and how much energy it would require. Having that information allows you to better understand where the vehicle might run out of charge and whether your routes are feasible to be operated using an electric truck,” Harry Baxter, EV Fleet Sales Director for bp pulse in Europe, shared with Girteka in an interview.

The added benefit – operators can use that information to map in public charging infrastructure, like bp pulse’s. “As a result, you can extend or pull together routes, so that the electric truck is not just traveling from depot to depot in order to charge. Instead, it can go from depot to public charger to depot. This allows you to extend your routes,” Baxter added.

Today, companies can choose to establish the required private or semi-private infrastructure by themselves to ensure that trucks are charged between stops, as well as at companies’ premises during loading and unloading procedures. Various charging strategies, such as overnight charging at the depot, are already being employed by hauliers to ensure that their goods continue moving.

A number of private charging point operators (CPOs) are ready to deploy truck charging infrastructure on a large scale in the near future. Bp has already established an extensive charging network in Germany under the Aral pulse brand, consisting of 300 kW chargers that trucks with their trailers attached can pull into. “Very soon we will be introducing 400 kW chargers to really speed up the time that it takes to charge the truck and trailer and get the driver back on the road, as time is of the essence,” Baxter points out.

The company will also be introducing “Autohoefe” – large scale, truck dedicated sites with up to 20 MW of available power. It is a significant amount of capacity that will enable truck charging throughout the day and night. Overall, bp pulse aims to install more than 100,000 charging points globally by 2030 and is more than a quarter of the way to reaching this with 27,000 charging points today.

Another example is Milence – an independent joint venture established in 2022 by Traton Group, Volvo Group, and Daimler Trucks. With €500 million in collective investments, the initiative aims to build and operate more than 1,700 fast (300 to 350 kW) and ultra-fast (1 MW) charging points for HDVs and coaches across Europe by 2027.

“AFIR will manage to support only a small share of the total number of battery electric vehicles in the total heavy truck fleet by 2030. In addition to the AFIR, private investments will be needed to make large scale electrification of goods transports happen. Milence plans to install and operate at least 1,700 high-performance charging points on, and close to, highways as well as at logistics hubs across Europe,” Widlund, the Electromobility Director at Volvo Trucks, told Girteka.

CO2 Emissions Standards for New HDVs

An important factor that will affect the expansion EV charging infrastructure is the regulation on CO2 emissions standards from new trucks. In October 2023, the Environment Committee of the European Parliament adopted its proposal to strengthen the regulation on EU CO2 emissions standards for new heavy-duty vehicles, which include buses, trucks and trailers.

The European Parliament is now aiming at more stringent CO2 reduction targets for medium- and heavy-duty trucks, which would be set at 45% as of 2030, 70% as of 2035 (compared to 65% proposed by the EC) and 90% as of 2040. In addition, all newly registered urban buses would be zero-emission vehicles (ZEVs) from 2030.

A recent study by the European Federation for Transport and Environment (T&E), analysed infrastructure targets agreed under the AFIR, as well as the additional deployment plans in Germany. It compared public charging availability with the projected energy demand of the zero-emission HDV fleet in 2030.

T&E found that the AFIR will provide public charging infrastructure across the EU to reduce the CO2 emissions from new HDVs by -65%. The analysis also claimed that it “will be more than enough” to meet the -45% target initially proposed under the HDV CO2 standards by the EC.

“Based on AFIR and the infrastructure plans in the central truck transit country Germany, we project that an annual charging energy of 13.79 TWh will be available in 2030,” states the T&E briefing, while adding that the calculations are based on “conservative assumptions such as utilisation of high-power chargers of only 4 hours per day.”

Looking at the zero-emission sales targets of the HDV CO2 standards, T&E estimated that the -45% target for 2030 would lead to a public energy demand from the battery electric truck and bus fleet of 8.13 TWh. That is 41% below the charging available under the AFIR and “risks leaving a large proportion of the planned infrastructure unused, potentially undermining the business case of companies such as Milence,” the analysis reads.

However, if the CO2 target for 2030 were to be increased to -65%, the HDV fleet would have a charging energy need of 14.25 TWh, “much closer to what the AFIR will provide”. According to T&E, the projected infrastructure would then be capable of supplying 97% of the required public charging demand. “[C]lean truck targets adequate to the expected availability of charging infrastructure are key for efficient utilisation and subsequently the business case for CPOs,” the study states.

Today, all stakeholders seem to agree that time is running out in enabling large-scale adoption of electric trucks. As Europe strives for greener and more sustainable transportation, providing the necessary infrastructure for the electrification of HDVs remains a significant part of the journey. Hence, all stakeholders need to do their part to help the logistics industry transition to electromobility and reduce its emissions. For the charging infrastructure to be rolled out in time and work efficiently, significant investments and coordinated action across both public and private sectors will be necessary.