Since 2020, one crisis has followed another, making uncertainty the new reality. The COVID-19 pandemic brought many businesses to a halt, triggering what was expected to be a temporary economic slowdown. The recovery that began in 2021 was stopped in its tracks by the outbreak of the war in Ukraine. A new economic and geopolitical crisis in an already fragile context ensued. The volatile events of last year have spilled over into 2023, significantly impacting demand for road freight services. What factors have led to this situation? And what should businesses keep in mind going forward?

Since 2020, one crisis has followed another, making uncertainty the new reality. The COVID-19 pandemic brought many businesses to a halt, triggering what was expected to be a temporary economic slowdown. The recovery that began in 2021 was stopped in its tracks by the outbreak of the war in Ukraine. A new economic and geopolitical crisis in an already fragile context ensued. The volatile events of last year have spilled over into 2023, significantly impacting demand for road freight services. What factors have led to this situation? And what should businesses keep in mind going forward?

The Role of Consumer Sentiment

Businesses, including those operating in the road transport industry, rely on economic indicators to make informed decisions about investments, hiring, and expansion plans. For the logistics industry, one of these indicators – consumer confidence – directly affects the demand for goods and the need for those goods to be transported.

A confident consumer base is more likely to maintain consistent demand for products and services, making it easier for businesses to plan and manage their operations efficiently. In logistics, where companies rely on efficient supply chain management, this means more predictable shipping volumes and schedules. But what happens when consumer optimism turns into pessimism?

Sharp Fall in Consumer Confidence

European consumer confidence hit an all-time low in September 2022, according to the European Union’s (EU) Directorate General for Economic and Financial Affairs (DG ECFIN). All of its components: households’ assessments of their past financial situation; outlook on their future financial situation; intentions to make major purchases; expectations about the general economic situation, contributed to the steep decline.

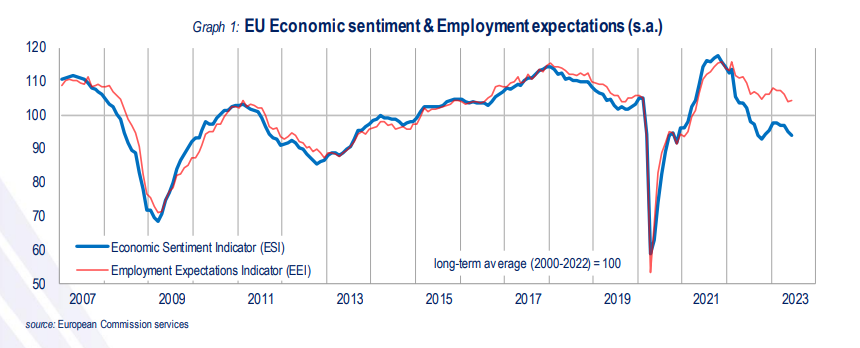

In September of last year, the overall Economic Sentiment Indicator (ESI), a composite indicator that reflects the attitudes of producers and consumers, fell both in the EU (-3.5 points to 92.6) and the euro area (-3.6 points to 93.7). Consumer uncertainty rose to a record high. From industrial, services, retail, to construction – a sharp dip was observed across all key sectors.

“In the EU, the marked decrease in the ESI in September was driven by a significant deterioration in confidence in all surveyed business sectors and another particularly sharp decline among consumers. Amongst the largest EU economies, the ESI fell markedly in Germany (-4.8), the Netherlands (-3.7), Italy (-3.7), France (-3.2), Poland (-2.4) and, to a lesser extent, Spain (-1.0),” according to the Business and consumer survey published in September 2022 by the European Commission (EC).

Another survey, carried out between September 23 and October 2, 2022, delved deeper into consumers’ attitudes and habits, illustrating the low consumer sentiment, particularly in Germany and France. The European Consumer Pulse Survey published by McKinsey & Company in October 2022, garnered the views of 1,000 respondents in each of Europe’s biggest economies – France, Germany, Italy, Spain, and the United Kingdom (UK).

According to the data, rising prices were the primary worry for 58% of European consumers at the time. This was followed by issues such as the war in Ukraine (12%), extreme weather events (8%), unemployment (7%), and political uncertainty (4%) – all clearly playing a much lesser role to that of inflation. Even during the pandemic, consumer pessimism has never been as high (32% in May 2020) as in the second half of 2022, with 43% of those surveyed expressing doubt about their own country’s economic recovery.

Recovery in Sight?

While working from home or shopping online have become the norm since the pandemic induced lockdowns, the soaring inflation throughout 2022 meant that more people began taking out money from savings to cover typical expenses, switching to more affordable options and spending less on non-essential items.

In November 2022, the Economic Sentiment Indicator increased for the first time since February of that year, in both the EU (+1.0 point to 92.2) and the euro area (+1.0 point to 93.7). As the EC points out, this increase was driven by “a rebound in consumer confidence, which more than outweighed a further deterioration of industry confidence”.

But the situation continued to be mixed entering 2023. The recovery of the general economic sentiment did not last long, coming to a halt in February (EU: ±0.0 points to 97.8, euro area: -0.1 points to 99.7). While there was lower confidence in industry and services, confidence in retail trade and among consumers increased.

By the end of Q2 2023, the ESI continued to decline further (EU: -1.1 points to 94.0, euro area: -1.1 points to 95.3). In contrast, overall consumer confidence continued its recovery from the pit of September 2022. The EC’s survey for June 2023 indicated that consumers were “more positive about their household’s financial situation, both over the past twelve months and especially for the next twelve months.”

Source: EC

Source: EC

What does this all mean for road haulage businesses? In essence, high consumer prices and insufficient wage rises have resulted in reduced consumption and a falling demand for goods to be transported across Europe in the first half of 2023.

“March 2023 data from the Eurostat shows that Eurozone wages grew 5.7% in the final quarter of 2022. However, these increases remain below inflation during that period, meaning consumers remain poorer in real terms. The effect can be seen in 2023 Q2 retail sales. Data from official sources puts consumption down vs the previous quarter in Germany (-7.2%), France (-3.6%), Poland (-0.7%), Italy (-2.3%) and Czechia (-0.1%),” as data from the quarterly European Road Freight Rate Benchmark, published by Upply, International Road Transport Union (IRU) and Transport Intelligence (Ti) in August 2023 shows.

Impact on Road Freight Rates

In 2022, road transport prices rose all over Europe. According to a White Paper, published by Upply, IRU and Ti back in Q3 2022, transport prices were on average, a staggering 19.6% higher at that time than in Q3 2021. However, the rise in prices also slowed due to the decrease in transport demand.

“This shift is mainly linked to a change in the supply-demand balance. After the strong post-Covid recovery, economic indicators are turning red. Inflation weighs on both production and household consumption, even though stocks are high across Europe. A decline in volumes is beginning,” the paper predicted.

Affected by declining demand, road freight transport prices in Europe continued to fall in Q2 of 2023. During this period, rates fell for the second consecutive quarter on the contract market and for the third consecutive quarter on the spot market, according to the Benchmark. The report highlights that this was “the first time in six years that the contract rate index has been higher than the spot rate index”.

On the one hand, road freight rates in the first half of 2023 were still somewhat influenced by higher costs, including that of labour and fuel (while diesel prices have fallen and stabilised, they remain higher than their pre-Ukraine war base). On the other hand, lower road freight prices have encouraged many companies to secure annual contracts, thinking they have more bargaining power in what they perceive as “a buyer’s market”.

Situation in the Road Freight Market

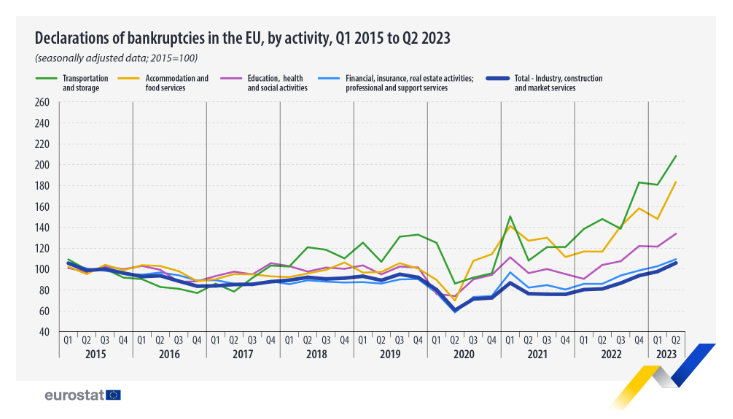

The most worrying trend, however, are the numbers of bankruptcies within the EU. In Q4 2022, business bankruptcies in the bloc increased significantly (+26.7% q-o-q), according to figures published by BNP Paribas and Eurostat. The highest levels were recorded in transportation and storage sectors (+147.3% compared to 2015), followed by accommodation and food service (+94.5% vs 2015).

Latest data from Eurostat indicates that in Q2 2023, bankruptcy levels reached their highest levels since 2015, increasing for the sixth quarter in a row and up by 8.4% q-o-q. This time, all sectors registered increases in the number of bankruptcies compared with the previous quarter. The highest increases, once again, were observed in accommodation, food services, transportation, and storage.

Source: Eurostat

This correlates with what the European Freight Association of International Freight Forwarders (Elvis) stated back in November 2022, in an interview with the newspaper Verkehrs Rundschau. The organisation warned of an approaching crisis within the transport and logistics industry, pointing to the decline in transport demand.

The association advised businesses, particularly small and medium-sized, to reconsider decisions about long-term investments and, if possible, to postpone them. Instead, transport companies were urged to make capacities more flexible by digitizing the workflow and improving efficiency, especially in contract business.

“In view of the volatile overall situation, we also recommend that companies coordinate closely with their customers and clients in order to be able to react quickly to changes,” stated Elvis board member Nikolja Grabowski, referring to price and capacity developments.

In fact, what we have seen recently is a major trend of gradual consolidation of the road transport market. An array of mergers and acquisitions within the industry were announced in 2022. Some of the best-known examples are the takeover of Gefco by CMA CGM or the ongoing plans to sell DB Schenker by its parent company Deutsche Bahn AG.

How Road Freight Companies Have Been Coping

The experience of the 2008 economic recession proved that large transportation conglomerates are more likely to remain stable during times of economic slowdown (in terms of growth, fleet size and market share). A good example of how a leading company in transportation and logistics not only managed to stay afloat but even brought their business back to profit is the DB Group, owned by the aforementioned Deutsche Bahn AG.

In a press release from March 2023, the Group announced that its logistics unit, DB Schenker, closed the 2022 financial year with the highest operating profit in its history. Nevertheless, the statement also noted that in the 2023 financial year, the very high energy costs and significantly inflated purchase prices will be a “burden” on the Group’s development.

In June 2023, Girteka Group also announced its highly successful financial results for 2022, but remained determined to continue investments in strategic projects such as fleet renewal, driver attraction initiatives, and digitalisation of operations. The company maintains that consistency and timely decision-making will play a key role for the remainder of the current year as well.

“Consumer sentiment’s rollercoaster ride has been a major factor driving road freight market fluctuations since 2020,” commented Tomas Šilinikas, Market Insights Director at Girteka Europe West. “As we navigate ongoing uncertainties, including high energy costs and inflation in 2023, logistics companies must remain adaptable and consider strategies like digitalization and flexible capacity management to thrive in this changing landscape,” he summarized.

What’s Next for the European Road Freight Market

Most forecasts indicate that the demand for road freight services may only recover starting 2024, presumably encouraged by the increasingly positive consumer and business sentiment throughout 2023. That is if no more major shocks interrupt Europe’s economic recovery. But before that happens, here is what businesses can expect:

- A combination of factors, including the spill-over of high inflation into 2023, will likely continue to weigh on consumer spending and consequently on the demand for road freight transport.

- Economic incertitude influencing consumers’ purchasing decisions will pose a challenge for manufacturers across various sectors to plan wisely for actual demand in the months ahead.

- Different sectors may experience varying pace of recovery and demand growth. This growth could further stimulate the market and result in higher manufacturing and production volumes across certain sectors.

As demand for European road freight services remains sluggish, it is also expected that in the upcoming months road freight rates will continue to fall both on the spot and the contract markets. Stagnation in demand will potentially open up even more capacity, increasing competition between road freight operators.

But as road freight transportation services become cheaper, prices in the contract market may not fall as much as in the spot market. This is because trucking companies still have a higher cost base, especially since the Mobility Package came into force.

“It is important to note that road freight prices in Europe remain on average 12-15% higher than before the pandemic, reflecting a structural increase in hauliers’ costs,” Thomas Larrieu, Chief Executive Officer at Upply, commented in a recent publication.

Let us not forget that the European Central Bank’s (ECB) decision to continue raising interest rates is one of the reasons for the reduction in demand for road freight transport. Higher interest rates also mean higher supply chain service costs.

Will Giants Fall?

Stagnating demand will remain the prevailing topic for the European road freight market in 2023. According to the latest data by Transporeon, presented in Ti‘s insights in September 2023, available capacity increased for the 14th consecutive month in August (a 12% increase for the European road freight capacity index compared to the same period in 2022).

The decline in volumes and decreased freight rates are now starting to affect even the major players within the industry. For example, revenue for DHL’s Forwarding Freight segment in the first half of 2023 was down by 40.3% and EBIT was down by 41.8% for half-year y-o-y. DSV Road freight segment’s revenue in the first half of 2023 was down by 4.5% y-o-y, and EBIT was down by 2.8% y-o-y.

Safe to say, despite the seemingly increasing consumer confidence, the crisis in the European road freight market is not over just yet.